Your Partners To Generational Wealth

Automate any broker account using data-driven strategies made by professionals

Start Your Investment Journey

Our Numbers Tell More About Us

$1B+

Assets Under

Management

70+

Years Of

Experience

15+

Managing Clients In Countries

15000+

People Managed

Our S.T.E.A.R Commitment to You

Service

Great service is the beginning of any great relationship. We pride ourselves on delivering a 7-star experience to all our clients. We’re committed to deliver you a stellar experience to fulfill your financial goals.

Trust

Outstanding service delivered consistently creates trust. We’re committed to living up to every single promise, setting the right expectations, and gaining your trust throughout our journey.

Empathy

Trusted partners have deep empathy for each other. We’re committed to listening & understanding your needs, wants, and fears & be there when you most need us.

Advice

We invest your money like we’d invest ours. We are committed to consistently do comprehensive research to always ensure the best for you & your family.

Relationship

Our clients stay with us for decades. We’re committed to guide you to stay on your financial roadmap to fulfill your financial goals & achieve generational wealth.

Your Partners To Generational Wealth

Build a financial roadmap with trusted partners to realise your ambitious financial goals.

Start Your Investment Journey

Your Partners To

Generational Wealth

Build a financial roadmap with trusted partners to realise your ambitious financial goals.

Our Numbers Tell More About Us

$1B+

Assets Under Management

70+

Years Of Experience

15000+

People Managed

15+

Managing Clients In Countries

Our S.T.E.A.R Commitment

We operate on the pillars of Service, Trust, Empathy, Advice, and Relationship:

Service

Delivering a 7-star experience to every client.

Trust

Building long-lasting relationships through consistent, transparent actions.

Empathy

Listening deeply to understand each client’s unique needs and aspirations.

Advice

Providing research-backed, unbiased guidance as if we were investing our own money.

Relationship

Supporting clients throughout their financial journey, often across generations.

Our S.T.E.A.R Commitment

We operate on the pillars of Service, Trust, Empathy, Advice, and Relationship:

Service

Delivering a 7-star experience to every client.

Trust

Building long-lasting relationships through consistent, transparent actions.

Empathy

Listening deeply to understand each client’s unique needs and aspirations.

Advice

Providing research-backed, unbiased guidance as if we were investing our own money.

Relationship

Supporting clients throughout their financial journey, often across generations.

Our Numbers Tell

More About Us

$1B+

Assets Under

Management

70+

Years Of

Experience

15+

Managing Clients In Countries

15000+

People Managed

Our S.T.E.A.R

Commitment to You

Service

Great service is the beginning of any great relationship. We pride ourselves on delivering a 7-star experience to all our clients. We’re committed to deliver you a stellar experience to fulfill your financial goals.

Trust

Outstanding service delivered consistently creates trust. We’re committed to living up to every single promise, setting the right expectations, and gaining your trust throughout our journey.

Empathy

Trusted partners have deep empathy for each other. We’re committed to listening & understanding your needs, wants, and fears & be there when you most need us.

Advice

We invest your money like we’d invest ours. We are committed to consistently do comprehensive research to always ensure the best for you & your family.

Relationship

Our clients stay with us for decades. We’re committed to guide you to stay on your financial roadmap to fulfill your financial goals & achieve generational wealth.

Our S.T.E.A.R

Commitment to You

Service

Great service is the beginning of any great relationship. We pride ourselves on delivering a 7-star experience to all our clients. We’re committed to deliver you a stellar experience to fulfill your financial goals.

Trust

Outstanding service delivered consistently creates trust. We’re committed to living up to every single promise, setting the right expectations, and gaining your trust throughout our journey.

Empathy

Trusted partners have deep empathy for each other. We’re committed to listening & understanding your needs, wants, and fears & be there when you most need us.

Advice

We invest your money like we’d invest ours. We are committed to consistently do comprehensive research to always ensure the best for you & your family.

Relationship

Our clients stay with us for decades. We’re committed to guide you to stay on your financial roadmap to fulfill your financial goals & achieve generational wealth.

As Featured In

As Featured In

As Featured In

Grow Old & Wise, Invest for Your Life

A financial plan is a road map to help people achieve their goals and this also applies to their retirement years

Outlook Money

Aug 18, 2021

Proposed regulations ignores ground realities

The mutual fund industry is close to garner Rs 20 trillion of Asset Under Management (AUM) but the distributor community is grappling with the new proposed rules.

Business Today

Aug 22, 2017

A leading financial expert’s top advice on how millennials can save money

If there’s one thing you notice about Roopa Venkatkrishnan, it is her ability to make you feel comfortable.

ELLE

Apr 8, 2022

A leading financial expert’s top advice on how millennials can save money

If there’s one thing you notice about Roopa Venkatkrishnan, it is her ability to make you feel comfortable.

ELLE

Apr 8, 2022

Grow Old & Wise, Invest for Your Life

A financial plan is a road map to help people achieve their goals and this also applies to their retirement years

Outlook Money

Aug 18, 2021

Proposed regulations ignores ground realities: FIFA Chairman Dhruv Mehta on Sebi's Mutual Fund advisory practice

The mutual fund industry is close to garner Rs 20 trillion of Asset Under Management (AUM) but the distributor community is grappling with the new proposed rules laid by the market regulator the Securities Exchange Board of India.

Business Today

Aug 22, 2017

A leading financial expert’s top advice on how millennials can save money

If there’s one thing you notice about Roopa Venkatkrishnan, it is her ability to make you feel comfortable.

ELLE

Apr 8, 2022

Grow Old & Wise, Invest for Your Life

A financial plan is a road map to help people achieve their goals and this also applies to their retirement years

Outlook Money

Aug 18, 2021

Proposed regulations ignores ground realities: FIFA Chairman Dhruv Mehta on Sebi's Mutual Fund advisory practice

The mutual fund industry is close to garner Rs 20 trillion of Asset Under Management (AUM) but the distributor community is grappling with the new proposed rules laid by the market regulator the Securities Exchange Board of India.

Business Today

Aug 22, 2017

A leading financial expert’s top advice on how millennials can save money

If there’s one thing you notice about Roopa Venkatkrishnan, it is her ability to make you feel comfortable.

ELLE

Apr 8, 2022

Grow Old & Wise, Invest for Your Life

A financial plan is a road map to help people achieve their goals and this also applies to their retirement years

Outlook Money

Aug 18, 2021

Proposed regulations ignores ground realities: FIFA Chairman Dhruv Mehta on Sebi's Mutual Fund advisory practice

The mutual fund industry is close to garner Rs 20 trillion of Asset Under Management (AUM) but the distributor community is grappling with the new proposed rules laid by the market regulator the Securities Exchange Board of India.

Business Today

Aug 22, 2017

Our Strong Leadership

Our Strong Leadership

Our Strong Leadership

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Chairman

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

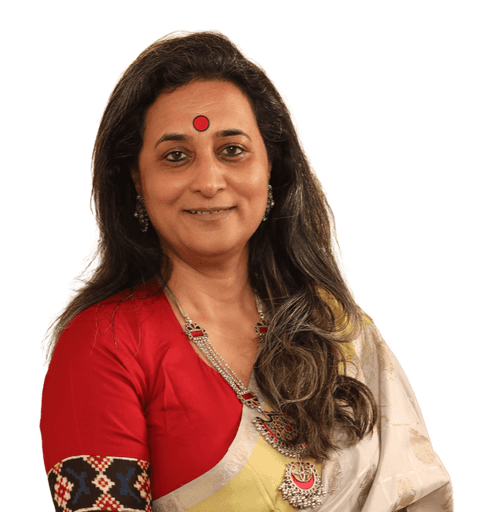

Roopa Venkatkrishnan

Director

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Paresh Kariya

Director

Meet our team

Our Strong Leadership

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Chairman

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Roopa Venkatkrishnan

Director

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Dhruv Mehta

Designation

Dhruv Mehta’s professional career spans over 30 years. The first 2 decades as a Corporate Executive before setting up his own boutique Wealth Management Firm in 2003. Over the last decade the Firm has evolved into one of India's leading firms in the Independent Financial Advisor (IFA) category & manages over $200M in assets.

Paresh Kariya

Director

Meet our team

What We Do Best

Wealth management

Customized strategies to grow, protect, and transfer your wealth effectively.

Estate Planning

Comprehensive planning to secure your legacy and distribute assets as desired.

Retirement Planning

Tailored solutions for a financially secure and comfortable retirement lifestyle.

Tax Planning

Strategic planning to minimize tax liabilities and optimize your financial situation.

Investment Advisory

Expert guidance to maximize returns and align investments with your goals.

Financial Planning

Holistic approach to achieve your financial goals and ensure long-term security.

Insurance

Protection solutions tailored to safeguard your assets and loved ones' futures.

Education Savings

Effective strategies to fund your children's education and secure their future.

Wealth management

Customized strategies to grow, protect, and transfer your wealth effectively.

Estate Planning

Comprehensive planning to secure your legacy and distribute assets as desired.

Tax Planning

Strategic planning to minimize tax liabilities and optimize your financial situation.

Retirement Planning

Tailored solutions for a financially secure and comfortable retirement lifestyle.

Investment Advisory

Expert guidance to maximize returns and align investments with your goals.

Financial Planning

Holistic approach to achieve your financial goals and ensure long-term security.

Insurance

Protection solutions tailored to safeguard your assets and loved ones' futures.

Education Savings

Effective strategies to fund your children's education and secure their future.

Who We Serve

Change the way you manage wealth

HNI/UHNI

NRIs

Women

Business owners

Genz & millennials investors

Retirees & Pre-retirees

Without Sapient

HNIs often face challenges in preserving and growing their wealth, dealing with intricate estate planning and investment decisions without clear guidance, leading to suboptimal outcomes.

With Sapient

At Sapient, we empower HNIs to make informed decisions that preserve and amplify their wealth. Our expert advisors provide clear, actionable guidance on estate planning and investment strategies, helping you secure your legacy for generations.

HNI/UHNI

NRIs

Women

Business owners

Genz & millennials investors

Retirees & Pre-retirees

Without Sapient

Business owners frequently encounter difficulties in securing their financial future and ensuring their business’s longevity, grappling with risks in succession planning and asset protection.

With Sapient

At Sapient, we empower HNIs to make informed decisions that preserve and amplify their wealth. Our expert advisors provide clear, actionable guidance on estate planning and investment strategies, helping you secure your legacy for generations.

HNI/UHNI

NRIs

Women

Business owners

Genz & millennials investors

Retirees & Pre-retirees

Without Sapient

HNIs often face challenges in preserving and growing their wealth, dealing with intricate estate planning and investment decisions without clear guidance, leading to suboptimal outcomes.

With Sapient

At Sapient, we empower HNIs to make informed decisions that preserve and amplify their wealth. Our expert advisors provide clear, actionable guidance on estate planning and investment strategies, helping you secure your legacy for generations.

HNI/UHNI

NRIs

Women

Business owners

Genz & millennials investors

Retirees & Pre-retirees

Without Sapient

HNIs often face challenges in preserving and growing their wealth, dealing with intricate estate planning and investment decisions without clear guidance, leading to suboptimal outcomes.

With Sapient

At Sapient, we empower HNIs to make informed decisions that preserve and amplify their wealth. Our expert advisors provide clear, actionable guidance on estate planning and investment strategies, helping you secure your legacy for generations.

HNI/UHNI

NRIs

Women

Business owners

Genz & millennials investors

Retirees & Pre-retirees

Without Sapient

HNIs often face challenges in preserving and growing their wealth, dealing with intricate estate planning and investment decisions without clear guidance, leading to suboptimal outcomes.

With Sapient

At Sapient, we empower HNIs to make informed decisions that preserve and amplify their wealth. Our expert advisors provide clear, actionable guidance on estate planning and investment strategies, helping you secure your legacy for generations.

We’re Global!

Global footprint in 15+ countries

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Global footprint in 15+ countries

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Expertise in simplified kYC, taxation and repatriation

We stay informed with our regular updates on global market trends, helping you make informed financial decisions worldwide.

Expertise in simplified kYC, taxation and repatriation

We stay informed with our regular updates on global market trends, helping you make informed financial decisions worldwide.

Tailored Investment Strategies

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Tailored Investment Strategies

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Trusted by Our Clients

Sapient Wealth Advisors have transformed my financial life. Their personalized advice and meticulous planning helped me navigate complex investment decisions with ease. I’m now on track to achieve my financial goals much sooner than expected. Their commitment to client success is truly exceptional.

Arjun rajan

Investor since 7 years

The team at Sapient is like a financial guardian angel. They take the time to understand your unique needs and craft strategies that align perfectly with your goals. I’ve seen substantial growth in my investments, and I couldn’t be happier with their service.

Kanishka Dubey

Investor since 7 years

Working with Sapient Wealth Advisors has been a game-changer. Their detailed analysis and strategic recommendations have significantly improved my portfolio’s performance. I appreciate their transparency and dedication to helping clients achieve financial independence.

Rahul Sethi

Investor since 7 years

Sapient Wealth Advisors have transformed my financial life. Their personalized advice and meticulous planning helped me navigate complex investment decisions with ease. I’m now on track to achieve my financial goals much sooner than expected. Their commitment to client success is truly exceptional.

Arjun rajan

Investor since 7 years

The team at Sapient is like a financial guardian angel. They take the time to understand your unique needs and craft strategies that align perfectly with your goals. I’ve seen substantial growth in my investments, and I couldn’t be happier with their service.

Kanishka Dubey

Investor since 7 years

Working with Sapient Wealth Advisors has been a game-changer. Their detailed analysis and strategic recommendations have significantly improved my portfolio’s performance. I appreciate their transparency and dedication to helping clients achieve financial independence.

Rahul Sethi

Investor since 7 years

See more

The Path to Financial Freedom

Start Investment Journey

STEP 1

Personalized Investment Strategy

We begin by understanding your unique financial situation, risk tolerance, and goals. This allows us to tailor an investment strategy that aligns with your aspirations.

STEP 2

Continuous Guidance and Monitoring

Investing is dynamic. We provide ongoing support to navigate market changes, ensuring your portfolio remains aligned with your objectives.

STEP 3

Accountability Checkpoints

Regular reviews and updates are crucial. We schedule periodic meetings to review progress, discuss any adjustments needed, and celebrate milestones achieved.

STEP 4

Education and Empowerment

We believe in empowering you with knowledge. We educate you on investment principles and market trends, empowering you to make informed decisions.

STEP 5

Access to Expertise

Our team of experienced professionals is here to answer your questions, provide insights, and offer proactive advice to optimize your investment journey.

The Path to Financial Freedom

Start Investment Journey

STEP 1

Personalized Investment Strategy

We begin by understanding your unique financial situation, risk tolerance, and goals. This allows us to tailor an investment strategy that aligns with your aspirations.

STEP 2

Continuous Guidance and Monitoring

Investing is dynamic. We provide ongoing support to navigate market changes, ensuring your portfolio remains aligned with your objectives.

STEP 3

Accountability Checkpoints

Regular reviews and updates are crucial. We schedule periodic meetings to review progress, discuss any adjustments needed, and celebrate milestones achieved.

STEP 4

Education and Empowerment

We believe in empowering you with knowledge. We educate you on investment principles and market trends, empowering you to make informed decisions.

STEP 5

Access to Expertise

Our team of experienced professionals is here to answer your questions, provide insights, and offer proactive advice to optimize your investment journey.

What We Do Best

Wealth management

Customized strategies to grow, protect, and transfer your wealth effectively.

Estate Planning

Comprehensive planning to secure your legacy and distribute assets as desired.

Retirement Planning

Tailored solutions for a financially secure and comfortable retirement lifestyle.

Tax Planning

Strategic planning to minimize tax liabilities and optimize your financial situation.

Investment Advisory

Expert guidance to maximize returns and align investments with your goals.

Financial Planning

Holistic approach to achieve your financial goals and ensure long-term security.

Insurance

Protection solutions tailored to safeguard your assets and loved ones' futures.

Education Savings

Effective strategies to fund your children's education and secure their future.

Wealth management

Customized strategies to grow, protect, and transfer your wealth effectively.

Estate Planning

Comprehensive planning to secure your legacy and distribute assets as desired.

Tax Planning

Strategic planning to minimize tax liabilities and optimize your financial situation.

Retirement Planning

Tailored solutions for a financially secure and comfortable retirement lifestyle.

Financial Planning

Holistic approach to achieve your financial goals and ensure long-term security.

Investment Advisory

Expert guidance to maximize returns and align investments with your goals.

Insurance

Protection solutions tailored to safeguard your assets and loved ones' futures.

Education Savings

Effective strategies to fund your children's education and secure their future.

Wealth management

Customized strategies to grow, protect, and transfer your wealth effectively.

Estate Planning

Comprehensive planning to secure your legacy and distribute assets as desired.

Retirement Planning

Tailored solutions for a financially secure and comfortable retirement lifestyle.

Tax Planning

Strategic planning to minimize tax liabilities and optimize your financial situation.

Investment Advisory

Expert guidance to maximize returns and align investments with your goals.

Financial Planning

Holistic approach to achieve your financial goals and ensure long-term security.

Insurance

Protection solutions tailored to safeguard your assets and loved ones' futures.

Education Savings

Effective strategies to fund your children's education and secure their future.

We’re Global!

Global footprint in 15+ countries

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Global footprint in 15+ countries

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Global footprint in 15+ countries

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Expertise in simplified kYC, taxation and repatriation

We stay informed with our regular updates on global market trends, helping you make informed financial decisions worldwide.

Expertise in simplified kYC, taxation and repatriation

We stay informed with our regular updates on global market trends, helping you make informed financial decisions worldwide.

Expertise in simplified kYC, taxation and repatriation

We stay informed with our regular updates on global market trends, helping you make informed financial decisions worldwide.

Tailored Investment Strategies

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Tailored Investment Strategies

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Tailored Investment Strategies

Our team navigates the complexities of cross-border finance, ensuring compliance and maximizing opportunities for international clients.

Trusted by Our Clients

Trusted by Our Clients

Trusted by Our Clients

Sapient Wealth Advisors bring a level of expertise that is hard to find. Their proactive approach to wealth management has not only secured my finances but has also educated me on making informed decisions. Their support has been invaluable on my financial journey.

Meera S.

Sapient Wealth Advisors have a rare ability to simplify complex financial concepts. Their tailored solutions have empowered me to make smarter investment choices. I trust them completely to guide my financial future, and they’ve consistently delivered excellent results.

Divya L.

Choosing Sapient Wealth Advisors was one of the best decisions I’ve made for my family’s financial future. Their in-depth knowledge and trustworthy guidance have provided us with peace of mind, knowing that our wealth is being managed with the utmost care.

Vikram M.

Sapient Wealth Advisors have transformed my financial life. Their personalized advice and meticulous planning helped me navigate complex investment decisions with ease. I’m now on track to achieve my financial goals much sooner than expected. Their commitment to client success is truly exceptional.

Anjali R.

The team at Sapient is like a financial guardian angel. They take the time to understand your unique needs and craft strategies that align perfectly with your goals. I’ve seen substantial growth in my investments, and I couldn’t be happier with their service.

Rajesh K.

Working with Sapient Wealth Advisors has been a game-changer. Their detailed analysis and strategic recommendations have significantly improved my portfolio’s performance. I appreciate their transparency and dedication to helping clients achieve financial independence.

Arjun P.

Sapient Wealth Advisors have transformed my financial life. Their personalized advice and meticulous planning helped me navigate complex investment decisions with ease. I’m now on track to achieve my financial goals much sooner than expected. Their commitment to client success is truly exceptional.

Anjali R.

Working with Sapient Wealth Advisors has been a game-changer. Their detailed analysis and strategic recommendations have significantly improved my portfolio’s performance. I appreciate their transparency and dedication to helping clients achieve financial independence.

Arjun P.

Lorem ipsum dolor sit amet consectetur. Sed lorem vitae mi turpis. Mauris purus nibh proin

Rajesh kumar

Investor since 7 years

Lorem ipsum dolor sit amet consectetur. Sed lorem vitae mi turpis. Mauris purus nibh proin Lorem ipsum dolor sit amet consectetur. Sed

Anjali mehta

Investor since 7 years

Lorem ipsum dolor sit amet consectetur. Sed lorem vitae mi turpis. Mauris purus nibh proin

Rajesh kumar

Investor since 7 years

Lorem ipsum dolor sit amet consectetur. Sed lorem vitae mi turpis. Mauris purus nibh proin Lorem ipsum dolor sit amet consectetur. Sed

Anjali mehta

Investor since 7 years

Sapient Wealth Advisors bring a level of expertise that is hard to find. Their proactive approach to wealth management has not only secured my finances but has also educated me on making informed decisions. Their support has been invaluable on my financial journey.

Meera S.

Sapient Wealth Advisors have a rare ability to simplify complex financial concepts. Their tailored solutions have empowered me to make smarter investment choices. I trust them completely to guide my financial future, and they’ve consistently delivered excellent results.

Divya L.

Choosing Sapient Wealth Advisors was one of the best decisions I’ve made for my family’s financial future. Their in-depth knowledge and trustworthy guidance have provided us with peace of mind, knowing that our wealth is being managed with the utmost care.

Vikram M.

Sapient Wealth Advisors have transformed my financial life. Their personalized advice and meticulous planning helped me navigate complex investment decisions with ease. I’m now on track to achieve my financial goals much sooner than expected. Their commitment to client success is truly exceptional.

Anjali R.

The team at Sapient is like a financial guardian angel. They take the time to understand your unique needs and craft strategies that align perfectly with your goals. I’ve seen substantial growth in my investments, and I couldn’t be happier with their service.

Rajesh K.

Working with Sapient Wealth Advisors has been a game-changer. Their detailed analysis and strategic recommendations have significantly improved my portfolio’s performance. I appreciate their transparency and dedication to helping clients achieve financial independence.

Arjun P.

The Path to Financial Freedom

Start Investment Journey

STEP 1

Personalized Investment Strategy

We begin by understanding your unique financial situation, risk tolerance, and goals. This allows us to tailor an investment strategy that aligns with your aspirations.

STEP 2

Continuous Guidance and Monitoring

Investing is dynamic. We provide ongoing support to navigate market changes, ensuring your portfolio remains aligned with your objectives.

STEP 3

Accountability Checkpoints

Regular reviews and updates are crucial. We schedule periodic meetings to review progress, discuss any adjustments needed, and celebrate milestones achieved.

STEP 4

Education and Empowerment:

We believe in empowering you with knowledge. We educate you on investment principles and market trends, empowering you to make informed decisions.

STEP 5

Access to Expertise

Our team of experienced professionals is here to answer your questions, provide insights, and offer proactive advice to optimize your investment journey.

The Path to Financial Freedom

Start Investment Journey

STEP 1

Personalized Investment Strategy

We begin by understanding your unique financial situation, risk tolerance, and goals. This allows us to tailor an investment strategy that aligns with your aspirations.

STEP 2

Continuous Guidance and Monitoring

Investing is dynamic. We provide ongoing support to navigate market changes, ensuring your portfolio remains aligned with your objectives.

STEP 3

Accountability Checkpoints

Regular reviews and updates are crucial. We schedule periodic meetings to review progress, discuss any adjustments needed, and celebrate milestones achieved.

STEP 4

Education and Empowerment:

We believe in empowering you with knowledge. We educate you on investment principles and market trends, empowering you to make informed decisions.

STEP 5

Access to Expertise

Our team of experienced professionals is here to answer your questions, provide insights, and offer proactive advice to optimize your investment journey.

The Path to Financial Freedom

Start Investment Journey

STEP 1

Personalized Investment Strategy

We begin by understanding your unique financial situation, risk tolerance, and goals. This allows us to tailor an investment strategy that aligns with your aspirations.

STEP 2

Continuous Guidance and Monitoring

Investing is dynamic. We provide ongoing support to navigate market changes, ensuring your portfolio remains aligned with your objectives.

STEP 3

Accountability Checkpoints

Regular reviews and updates are crucial. We schedule periodic meetings to review progress, discuss any adjustments needed, and celebrate milestones achieved.

STEP 4

Education and Empowerment:

We believe in empowering you with knowledge. We educate you on investment principles and market trends, empowering you to make informed decisions.

STEP 5

Access to Expertise

Our team of experienced professionals is here to answer your questions, provide insights, and offer proactive advice to optimize your investment journey.

Contact Us

Frequently Asked Questions

What services does your company provide?

We offer a comprehensive range of financial services, including wealth management, loan planning, retirement planning, tax planning, investment advice, insurance services, and education savings plans. Our goal is to help you achieve financial security and grow your wealth.

How do I get started with your services?

Who are your typical clients?

What makes your services unique?

Are your services available globally?

How to ensure my financial information's security?

What is your fee structure?

Can I schedule a consultation online?

How can I get in touch with my advisor?

Do you offer services for NRIs?

Frequently Asked Questions

What services does your company provide?

We offer a comprehensive range of financial services, including wealth management, loan planning, retirement planning, tax planning, investment advice, insurance services, and education savings plans. Our goal is to help you achieve financial security and grow your wealth.

How do I get started with your services?

Who are your typical clients?

What makes your services unique?

Are your services available globally?

How to ensure my financial information's security?

What is your fee structure?

Can I schedule a consultation online?

How can I get in touch with my advisor?

Do you offer services for NRIs?

Frequently Asked Questions

How to ensure my financial information's security?

What is your fee structure?

Can I schedule a consultation online?

How can I get in touch with my advisor?

Do you offer services for NRIs?

What services does your company provide?

We offer a comprehensive range of financial services, including wealth management, loan planning, retirement planning, tax planning, investment advice, insurance services, and education savings plans. Our goal is to help you achieve financial security and grow your wealth.

How do I get started with your services?

Who are your typical clients?

What makes your services unique?

Are your services available globally?

Achieve ambitious financial goals with a strategic investment roadmap tailored for you & your family.

Sapient Wealth 2024 All Rights Reserved. Designed by Bricx

Achieve ambitious financial goals with a strategic investment roadmap tailored for you & your family.

Sapient Wealth 2024 All Rights Reserved. Designed by Bricx

Achieve ambitious financial goals with a strategic investment roadmap tailored for you & your family.

Sapient Wealth 2024 All Rights Reserved. Designed by Bricx

Achieve ambitious financial goals with a strategic investment roadmap tailored for you & your family.

Sapient Wealth 2024 All Rights Reserved. Designed by Bricx

Frequently Asked Questions

How do I get started with your services?

Who are your typical clients?

What makes your services unique?

Are your services available globally?

Frequently Asked Questions

How do I get started with your services?

Who are your typical clients?

What makes your services unique?

Are your services available globally?